By Maria Leonard Olsen, Esq.

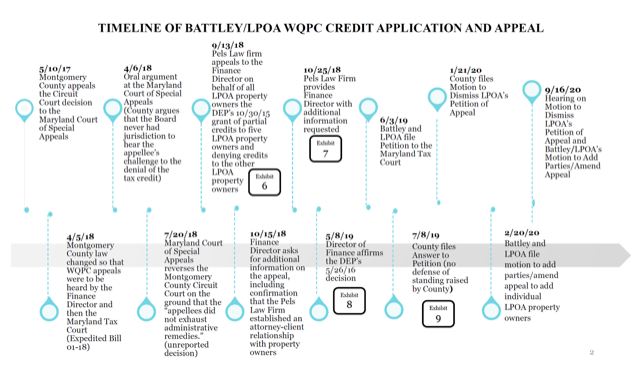

Pels Law had an actual in-person hearing this week, a rarity during the Covid era. The case had a complicated procedural history, in which the local government was forcing our clients to jump through multiple hoops to obtain relief from the “rain tax.” The rain tax is the Water Quality Protection Charge that Montgomery County charges property owners who have impervious surfaces on their property. The case provided another example of how the use of a timeline to show the damaging actions of your opponent can be a very effective exhibit in showing the trier of fact the merits of your argument, as it was in this case.

The tribunal was the Maryland Tax Court. The clients had been forced to appeal their case through four administrative agency levels and two courts. The litigation started in 2015 and the appeals process was changed during the pendency of this case, forcing the clients to re-file in another agency. There still is no resolution in this case.

The latest hoop the government constructed for our clients involved a motion to dismiss for lack of standing, five years into the litigation. Our strategy included showing the Court exactly what our clients have had to go through at the hands of the government to get their case heard. And it is not over yet.

Our lead attorney, Jon Pels, 2007 Trial Lawyer of the Year, had an excellent strategy for the hearing. He is adept at seeing the case through the eyes of a judge. His experience has equipped him to zero in on exactly what will persuade a judge to rule in a client’s favor.

Jon asked to approach the bench to hand the judge a timeline of the filings and actions in the case. With each major juncture in the case’s history, Jon referred the judge to an exhibit attached to the timeline. Jon highlighted the salient points contained in each exhibit along the timeline. The legal odyssey was aptly demonstrated and the injustice of the government’s actions was well-demonstrated.

The strategy worked. While the procedural history was set forth in the briefing papers submitted, the judge was impressed by the linear depiction of the case in timeline form. The lengths to which the government went to block the taxpayers’ efforts was starkly on display.

The Tax Court denied the County’s Motion to Dismiss, removing the final barrier prior to trial at the State level. A simple graphic exhibit proved to be just the right strategy to illustrate the injustice in this case.